Kunal Patel, Dallas Federal Reserve, joins Jason Spiess, founder of ESG University to review the latest energy survey and discuss their upcoming Energy and the Economy: Meeting Rising Energy Demand in November.

The Dallas Fed conducts a quarterly survey of about 200 oil and gas firms located or headquartered in the Eleventh District—Texas, southern New Mexico and northern Louisiana—which operate regionally, nationally or internationally.

The information collected is a valuable component of economic analysis and serves as input for Federal Open Market Committee monetary policy deliberations. Survey respondents are asked whether various measures of their firms' business activities have increased, decreased or remained unchanged relative to the prior quarter and the year-ago quarter. Responses are aggregated into diffusion indexes; positive values indicate expansion while negative values indicate contraction.

Activity in the oil and gas sector grew in the second quarter of 2024, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index, the survey’s broadest measure of the conditions energy firms in the Eleventh District face, increased from 2.0 in the first quarter to 12.5 in the second quarter.

Oil and gas production was little changed in the second quarter, according to executives at exploration and production (E&P) firms. The oil production index advanced from -4.1in the first quarter to 1.1 in the second quarter. The near-zero reading suggests production was essentially unchanged. Meanwhile, the natural gas production index also turned positive, but barely so, increasing from -17.0 to 2.3.

Costs rose at a slightly faster pace for oilfield services, but at a slower pace for E&P firms. Among oilfield services firms, the input cost index increased from 31.2 to 42.2. Among E&P firms, the finding and development costs index declined from 24.2 to 15.7. Meanwhile, the lease operating expenses index declined from 33.7 to 23.6.

The equipment utilization index of oilfield services firms turned positive, increasing from -4.2 in the first quarter to 10.9 in the second. The operating margin index remained negative but increased from -35.4 to -13.0, suggesting margins declined at a much slower pace. The index of prices received for services was relatively unchanged at -4.4.

The aggregate employment index was little changed at 2.9 in the first quarter. While this is the 14th consecutive positive reading for the index, the low-single-digit result suggests slow net hiring. The aggregate employee hours index was largely unchanged at 8.1. Additionally, the aggregate wages and benefits index decreased from 32.8 to 24.0.

The company outlook index was essentially unchanged at 10.0. The outlook index was 16.8 for E&P firms compared with -2.1 for services firms, suggesting modest optimism among E&P firms and a neutral outlook among services firms. The overall outlook uncertainty index was unchanged at 24.1, suggesting uncertainty continued to increase on net.

On average, respondents expect a West Texas Intermediate (WTI) oil price of $79 per barrel at year-end 2024; responses ranged from $62.5 to $100 per barrel. When asked about longer-term expectations, respondents on average expect a WTI oil price of $83 per barrel two years from now and $88 per barrel five years from now. Survey participants expect a Henry Hub natural gas price of $3.01 per million British thermal units (MMBtu) at year-end. When asked about longer-term expectations, respondents on average anticipate a Henry Hub gas price of $3.58 per MMBtu two years from now and $4.28 per MMBtu five years from now. For reference, WTI spot prices averaged $79.94 per barrel during the survey collection period, and Henry Hub spot prices averaged $2.61 per MMBtu.

Questions regarding the Dallas Fed Energy Survey can be addressed to Michael Plante at Michael.Plante@dal.frb.org or Kunal Patel at Kunal.Patel@dal.frb.org

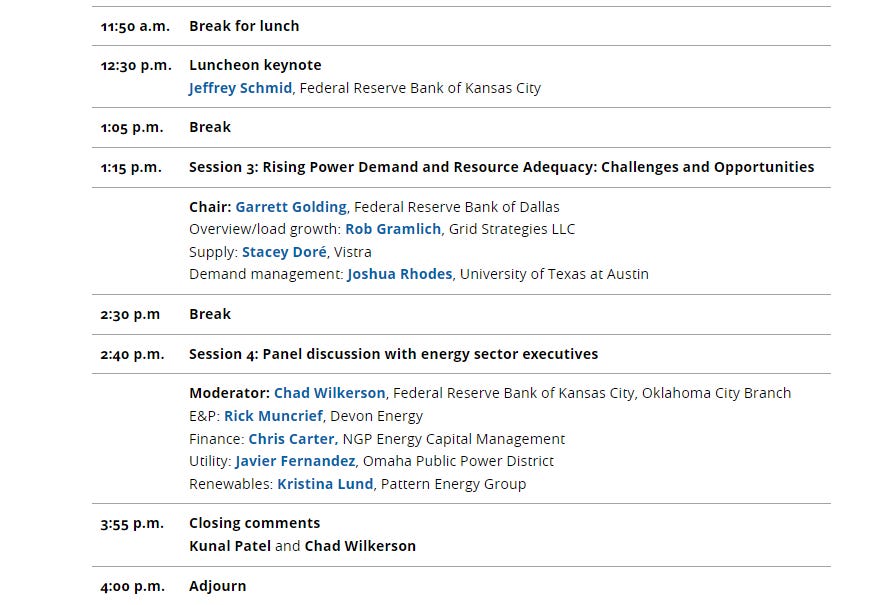

Energy and the Economy: Meeting Rising Energy Demand

The ninth joint energy conference hosted by the Federal Reserve Banks of Dallas and Kansas City will focus on the outlook for global energy markets as well as developing domestic energy infrastructure at scale and meeting rising power demand. Participants include business leaders, central bankers, government officials, academics and financial market representatives.

When

Wednesday, November 13, 2024

Breakfast: 7:30 a.m. CT

Conference: 8:40 a.m.–4 p.m. CT

Where

Federal Reserve Bank of Dallas

2200 N. Pearl St.

Dallas, TX 75150

Directions

Registration

The conference will be hybrid. Attend in person for $149, or live stream at no cost.

For more information contact Kunal Patel at Kunal.Patel@dal.frb.org.

STREAMING DEAL FROM PARAMOUNT +

For a limited time, Paramount+ annual plans start at $2.50/mo. for 12 months using promo code FALL50. Stream the NFL on CBS live and more! Don't drop the ball—this special offer ends September 23. Billed annually. Terms and conditions apply.

Stream the NFL on CBS and watch your local game live every week! Plus, catch featured national games including the Thanksgiving matchup and the postseason.

Don't miss another snap. Take advantage of this limited time offer and stream the NFL on CBS live on Paramount+. Redeem now!

CLICK HERE FOR LIMITED TIME OFFER

ACT NOW! For a limited time, Paramount+ annual plans start at $2.50/mo. for 12 months using promo code FALL50.

Take advantage of this limited time offer and stream the NFL on CBS live on Paramount+. Redeem now!

Patel Recaps the Latest Dallas Fed Energy Survey, Details Energy Event