This past Wednesday on SuperTalk 1270-AM’s Talk of the Town with Steve Bakken and special guest co-host ESG University founder Jason Spiess, Justin Buckingham joined as a guest who was “standing ground” against a potential eminent domain infringement on his land rights by Summit Carbon Solutions and the state of North Dakota.

Buckingham, and wife Danielle, bought the property over three years ago and there was no mention or indication of any pipeline going through the property at that time.

The two were asked when Summit Carbon Solutions first indicated they were interested in putting a pipeline through their property since there was none at the time when they purchased the land.

“That was last year around September. It was pretty brief,” Buckingham said in regards to when Summit first reached out. “We purchased our property about three years ago. We're going on our third or fourth year and there was no sign of any pipeline coming through or anything. So we thought it was gonna be a wonderful property to buy and purchase in Burleigh County here to set up a little farm operation.”

Buckingham, who used to work for energy companies, has experience with land professionals, carbon injections and pipeline companies, said Summit’s tactics are unprofessional, ruthless and nothing like the oil and gas pipeline professionals.

“I knew what CO2 was. I used to work for Chevron with CO2 injection for a little bit down in Rangely, Colorado, so I understood what CO2 was,” Buckingham said. “I'm also a consultant, former consultant in oil and gas and directional driller at the highest level there. So I have full understanding of this.”

Buckingham, who is originally from Watford City, dreamed of returning to North Dakota for a good life and starting a new chapter in his family’s wife. What he’s gotten so far is nothing short of a nightmare.

“We dealt with oil and gas tactics before in Watford City, you know, land men that were local and they're friendly. They come to your door, very honest, straight to the point. We work together,” Buckingham said. “The tactics that Summit uses, it is almost as if they're a terrorist.”

He continued describing his and his neighbor’s experiences dealing with this company consisting of global billionaire investors acting as “terrorists” on American soil.

“They just come and they are taking land and don't care about you as a person. That is their tactic,” Buckingham said. “They threatened us.”

Justin also fears for his wife Danielle and their children’s safety on multiple fronts. From a simple fear of strangers coming and going while feeling entitled on someone else’s private property to the health and safety issues with a Carbon Pipeline near children.

“With this CO2 line, we have four children that attend the school where the line is running through about a mile away,” Buckingham said. “And so we were very concerned with our children even having a line like that in our yard… it's just unreal.”

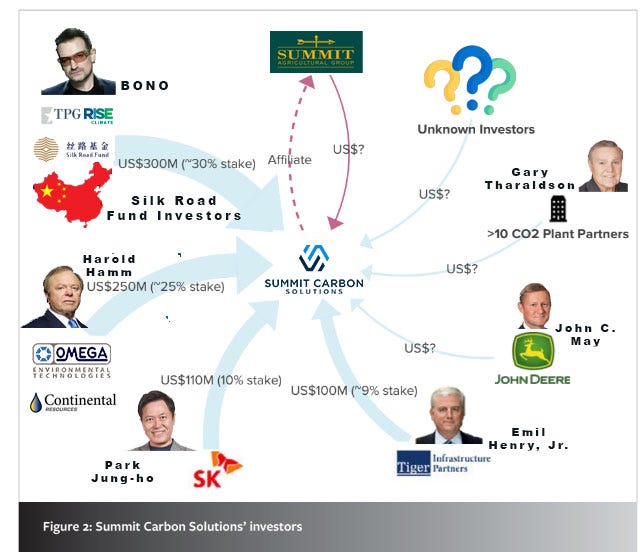

According to a recent study released by The Oakland Institute, which was commissioned by a group of concerned landowners, it shows that Silk Road Fund, a Chinese-based company is one of the major investors in a controversial Midwest pipeline project.

The new study shows the ownership of the pipeline project and TPG Rise is listed as the largest investor in the carbon pipeline at 30%.

On July 27, 2021, Silk Road Fund participated as an anchor investor into TPG Rise Climate Fund.

The Fund, targeting to reach $7 billion hard cap in total capital commitment, will take a broad sector approach and focus on five core sub-sectors: clean energy, decarbonized transport, greening industrials, enabling solutions, and agriculture & natural solutions.

This investment represents another significant effort in ESG investment of Silk Road Funds, through which they aim to expand its green investment coverage, promote high-quality green Belt and Road cooperation, and enhance cooperation in international green financing.

Along with other global investors, TPG and Silk Road Funds will join the global ESG efforts to “combat climate change, and accelerate and scale climate solutions”.

Since its inception, Silk Road Funds have been advocating and practicing ESG principles in its investment, and is committed to contributing to achieve the globally shared goal of 'carbon neutrality'.

Silk Road Funds will continue to play a role in catalyzing capital to combat climate change and increase its footprint in green investment, and promote green Belt and Road cooperation.

The practice of Eminent Domain has been happening in America since the days of the railroad, if not before. Only this time it isn’t taking land for the distribution of goods, services and people as the “greater good”.

No, this time it’s simply just a cold-hearted real life example of how ESG Eminent Domain works for billionaires and modern day public-private partnerships.

While some believe U.S. Senator John Hoeven (R-ND) and North Dakota Governor Doug Burgum are politically posturing and profiting off both sides of the ESG narrative, and this CO2 Pipeline is just another example, United States landowners are literally seeing their private property rights eroded and destroyed right before their eyes. And in some real life examples, it is happening on their own property.

“I wouldn't have bought this property at all if I knew this pipeline is coming through, we would have never even come here,” Buckingham said.

Other Concerns, Landowners and Protest

Currently the Protest War Drums are beating loud in the Upper Midwest that might see history repeating itself, only this time it’s a Carbon Pipeline, a oil tycoon, a Chinese-owned company and an international environmentalist music icon.

That’s quite a cast of characters getting billions of American tax dollars for storing Corn Carbon Waste from ethanol fuel, which receives billions in American tax dollar subsidies.

This Pipeline Protest is becoming more complex by the minute.

For many in North Dakota, the memory of a pipeline protest is still fresh. In the spring of 2016 protests began at pipeline construction sites in North Dakota and drew indigenous people, calling themselves water protectors and land defenders, from throughout North America as well as many other supporters, creating the largest gathering of Native Americans in the past hundred years.

What often goes under reported about the DAPL protest is that Iowa was heavily involved against the pipeline as well.

According to state and federal authorities, there were several cases of arson that damaged pipeline construction equipment in Iowa during 2016. One deliberately set fire caused nearly $1 million in damage to construction equipment in August in Jasper County, Iowa. Two other fires involving pipeline construction equipment were set around the same time in the same county and another was set in Mahaska County.

In October, another arson fire caused $2 million worth of damage to pipeline construction equipment in Jasper County, Iowa

While the protests drew international attention and were said to be "reshaping the national conversation for any environmental project that would cross the Native American land", there was limited mainstream media coverage of the events in the United States until early September 2016. At that time, construction workers bulldozed a section of land that tribal historic preservation officers had documented as a historic, sacred site, and when protesters entered the area security workers used attack dogs, which bit at least five of the protesters. The incident was filmed and viewed by several million people on YouTube and other social media.

Will this pipeline become another Boondoggle filled with state-sponsored attack dogs against the people?

Here is a list of the other Billionaire Investors and companies partnering with the Chinese-based Silk Road Funds are now business partners with.

As of February 4, 2022, Harold Hamm's net worth is estimated to be US$49.3 billion, making him the 63rd wealthiest person in the world. He is the founder and chairman of Continental Resources and owner of Omega Acquisition, or Omega Environmental Technologies.

Omega Acquisition is an Oklahoma corporation, “100% of the capital stock of which is owned by Harold G. Hamm”.

Continental Resources is a top 10 independent oil producer in the U.S. and a leader in America's energy renaissance. Based in Oklahoma City, Continental Resources is very active in the Bakken play of North Dakota and Montana.

The Company is also the largest producer in the Anadarko Basin of Oklahoma and is the second largest leaseholder in the Powder River Bain of Wyoming and tenth largest in the Permian Basin of Texas.

In 2022, the Company celebrated 55 years of operations.

Gary Tharaldson is one of the Ethanol Refinery owners who is invested into the Midwest Carbon Express pipelines. Tharaldson is an American entrepreneur and founder of the Tharaldson Companies. As of 2019, Tharaldson is the wealthiest individual in North Dakota, and the state's only billionaire. Gary Tharaldson was born in and grew up in Dazey, North Dakota.

According to ND Ethanol there are six ethanol plants in North Dakota in the state. Tharaldon Ethanol is the only investor and participant in the carbon pipeline.

Tharaldson Ethanol is located just West of Casselton, ND, an area known for its rich farming tradition. Tharaldson Ethanol provides a much-needed local market for area corn growers, requiring about 60 million bushels of corn annually, which will in turn produce 170 million gallons of ethanol and about 450,000 tons of dried distiller’s grain each year.

One of the foreign partners raising eyebrows in the Midwest is SK Partners, who has a long history of questionable business practices.

According to the United States Justice Department’s news service:

South Korea-based companies SK Energy Co. Ltd., GS Caltex Corporation, and Hanjin Transportation Co. Ltd. have agreed to plead guilty to criminal charges and pay a total of approximately $82 million in criminal fines for their involvement in a decade-long bid-rigging conspiracy that targeted contracts to supply fuel to United States Army, Navy, Marine Corps, and Air Force bases in South Korea, the Department of Justice announced today.

The Department of Justice Documents show SK Holdings pleaded guilty in 2018 and again in 2020 to Government Fraud. Another case was listed as a settlement, while another is still pending.

DOJ says SK obtained a large land development contract at the Camp Humphreys base near Seoul in 2008 “worth hundreds of millions” after paying $2.6 million in bribes to an Army Corps of Engineers official. Payments went through a fake Korean contractor SK set up to submit the false documents to the Army to cover up the fraud. Construction of the 3,500-acre base, one of the military’s largest anywhere, is set for completion by 2021 with costs estimated over $11 billion.

Deere & Company, doing business as John Deere, is an American corporation that manufactures agricultural machinery, heavy equipment, forestry machinery, diesel engines, drivetrains used in heavy equipment, and lawn care equipment. The company also provides financial services and other related activities.

John Deere is headquartered in Moline, Illinois.

Tiger Infrastructure Partners LP operates as a private equity firm. The Firm focuses on control investments in middle-market infrastructure assets and businesses, as well as invests in power, infrastructure, waste management, water, transportation, communications, and related sectors.

Tiger Infrastructure Partners serves clients in the North America and Europe.

“As an infrastructure investor committed to investing in businesses based on both returns to our investors and on environmental, social, and governance (“ESG”) principles, Tiger believes Summit Carbon Solutions is exceptionally well positioned to deliver. It has been a great pleasure from the beginning to see this project take shape, and we are confident in Summit’s ability to execute with the world class management team it has assembled. Summit Carbon Solutions will make a substantial and tangible impact our nation’s carbon footprint and Tiger is excited to play a key role in its success,” said Marc Blair, Managing Director of Tiger Infrastructure Partners.

On March 20, 2023, The New York Times published a story focusing on the human element of the pipeline.

The projects, if built, would be a major expansion of the country’s existing network of more than 5,300 miles of carbon pipelines. Some along the routes question whether the technology is fully proven and safe, citing the explosion of a carbon pipeline in Mississippi in 2020 that led to the hospitalization of 45 people and a federal review of safety standards.

“If one of them breaks, there’s absolutely nothing I can do but turn tail and run and hope to hell I don’t die,” said Donald Johnson, a chief of the volunteer fire department in Valley Springs, a small town along South Dakota’s border with Minnesota, near where the Navigator pipeline would run.

There has been a growing sense among landowners that leaders “of both of our parties are screwing us with this deal and looking the other way,” said Chase Jensen, an organizer and lobbyist for Dakota Rural Action, an agriculture and conservation group that opposed Keystone XL and is against the carbon pipelines. Some landowners who supported the oil pipelines, he said, were reconsidering those views in light of the carbon projects.

At the end of the day, one thing is certain, the pipeline protestors are not going away anytime soon.

Bonus Coverage: BEK News is currently airing a 10-part series on the CO2 Pipeline. The series airs Sunday nights on BEK TV. Click here for more information.

THE MANY WAYS YOU SUPPORT ESG UNIVERSITY!

Questions or Comments? Do you have an ESG University story idea or Screenshot Submission? Email: hello(at)esgu(dot)org

Supporting ESG University is more important than ever. Education and awareness are the best ways to tackle a complex problem, but it takes resources.

Raising awareness, presenting different angles to issues and insightful essays are some of the ways ESG University is helping others understand.

Click here for MyStore (promo code OTIS)

Click here for MyPillow (promo code OTIS)

Would you like to support ESG University? If so, we have a few FREE ways to support - subscribe, like, share and/or comment below!

HOWEVER….. We keep the lights on with paid subscriptions. Please consider supporting ESG University and subscribe today!

Or DONATE VIA VENMO (click on here to donate)

ESG University Services

ESG Internal Audits

ESG Reports

ESG Consulting

ESG Speaking

If you would like to have your Op/Ed considered for publication, email hello(at)ESGU(dot)org

The views and opinions may not necessarily reflect the views of ESG University, but they do reflect someone’s point of view. ESG University believes all energy has a purpose and we are all energy. All views are welcome at ESG University.

Landowner Interviewed on Live Radio says his Family Feels "Violated by Summit Carbon Solutions"